If you’re looking for a reliable, compassionate and aggressive legal partner, you’ve come to the right place. No matter what you’re going through, at Johnson, Vorhees & Martucci, we have the people and expertise to help you come out on top.

Dedicated to Making Things Right.

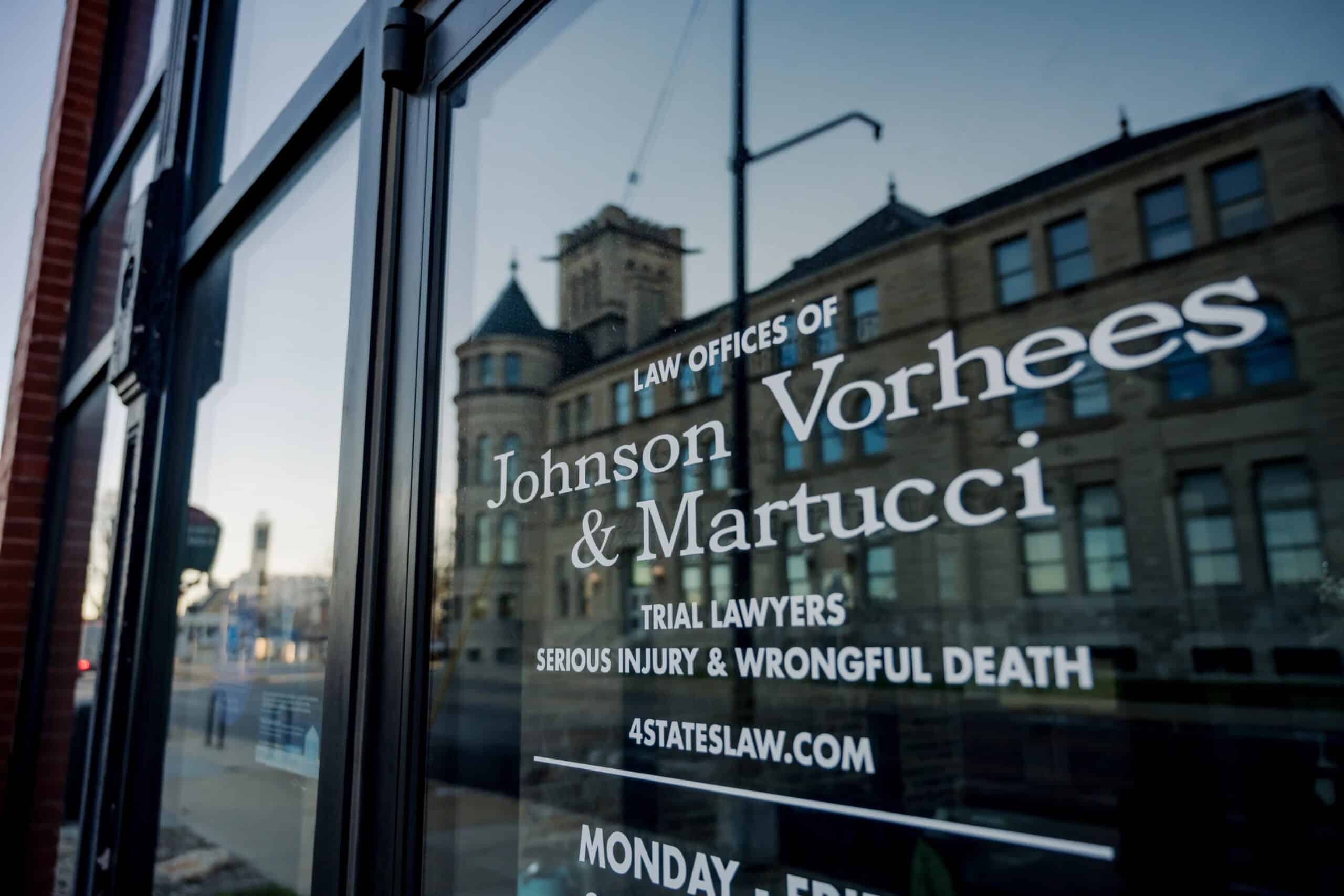

We are Johnson, Vorhees & Martucci, personal injury attorneys in the Four States area.

See our story here:

Giving Our All for You

Relentless Legal Skill.

We exhaust all legal options. We’re feared by insurance companies. But more importantly, we know how to help you win what you deserve, and we are willing to stand up for you.

Serving You Beyond the Case.

Getting the judgment you deserve is just the beginning. We stay with you no matter what happens next because your wellbeing is priority number one.

Lasting Change & Improvement.

For us, winning cases isn’t enough. Our mission is to level the playing field and do everything in our power to prevent bad things from happening to good people.

Get Award-Winning Attorneys in Your Corner.

You don’t get awarded for losing. Schedule a free consultation to see how we can win together.

Joplin Office

510 W. 6th Street

Joplin, MO 64801

417-206-0100

Springfield Office

444 S Campbell Ave

Springfield, MO 65806

417-720-1366

Expertise

Experts in Never Backing Down.

After thousands of hard fought case wins, we know what it takes to get you the justice you deserve – no matter what you’re going through.

Our Attorneys

Meet Our Fearless Team.

ROGER ALAN JOHNSON

Founding Partner

Scott J. Vorhees

Partner

Patrick Martucci

Partner

Brian Johnston

Springfield Partner

Glenn Russell Gulick Jr.

Of Counsel

Anna Pace-Johnson

Partner

Josh Decker

Partner

Max Blaser

Springfield Attorney

Clients Always Come First

Get a Free Initial Consultation.

When you need help, we’re here – and you won’t pay a dime until we win the case.